The credit card payment method is something most people in urban and rural areas get involved with each day, but there are certain unique cards that offer benefits that those who use them enjoy exclusively. For this reason, we will examine the Burlington credit card and the associated benefits attached to using it. Also, readers would love to know if there are any disadvantages before they start using it. Practically, everything on earth has some disadvantages. Read on to find out which applies to Burlington credit card usage as you read the rest of this article.

The history of Burlington

In former times, this company (Burlington) was knowns was known as Burlington Coat Factory Warehouse Corporation. The company had branches in many areas of the US and also in Puerto Rico. However, its origin is in the Burlington Township of New Jersey. The company is known for setting up companies where it is sure to find enough traffic for more commercialism. Today, the Burlington credit card is issued by Comenity Capital Bank.

However, in this post, we will concentrate on the following areas:

- Features of the Burlington card

- How to obtain one

- How to use it for transactions

- Examination of other frequently asked questions about the card

- Why you should choose the Burlington card

Why should you choose the Burlington card?

A special reason why you may want to consider choosing this card is the reason that you shop at Burlington. With the company’s credit card, you’re in line for great deals or bargains that other people who shop there can’t get. It feels good to have this opportunity at Burlington because the company has enough incredible deals and bargains to go around. That’s another attraction for customers. In most cases, everyone gets to benefit over time. Scroll down to read the full benefits of using a Burlington credit card.

How to obtain a Burlington credit card

To obtain the Burlington credit card, you need to apply for it as anybody would. There are some requirements you also need to check out as you must be able to fulfill the company’s normal requirements before you are given one of their cards.

That said, the Burlington credit card can’t be used from just anywhere in the world. If you are based in Africa but you often travel out to an area where Burlington shops are, you could require a Burlington card for yourself.

You will need the following requirements before you can get this credit card:

- You need a good credit score of about 630 or more

- In the area where you’re located, you must be confirmed to be of legal drinking age

- You need to have a government-issued identification number like the TIN, SSN, or SIN. All these must be checked and must be valid before there are accepted

- You need a street address or an FPO/APO address

- You also need a valid government-issued photo identity card

- You must have been known to visit Burlington stores that are close to where you live

If you’re sure that you will be accepted, click here to require a Burlington credit card now. You can also apply by physically visiting any of their stores close to where you live. Remember, the higher your credit scores the better for you. It really helps to boost your chances of getting accepted.

Cool benefits of using Burlington credit card

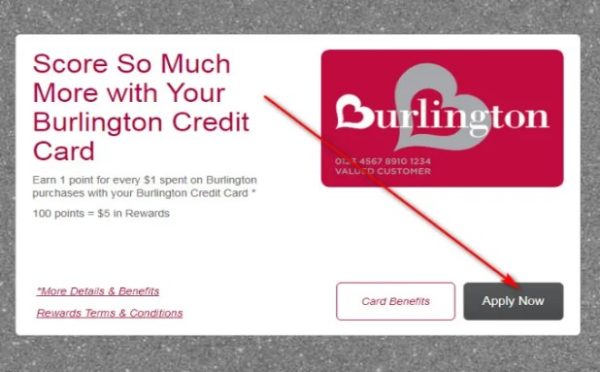

For one thing, those with the card earn one point for every $1 spent on their Burlington credit card. They can also get a new card-holder discount offer for the same day the card was used.

Burlington credit card users also get the following benefits:

- Users get 10 percent of the first purchase they make in the store when they use the credit card on the same day they opened the card account. This is a valid one-time offer

- You can automatically receive a print and e-receipt

- You get a $5 bonus on all completed layaways

- Be the first customer to hear about the new arrivals and markdowns

- Users get receipt-free returns on Burlington purchases

- Also, earn $5 in rewards for every 100 points that you’ve accumulated – this offer is exclusive to some types of members, such as those enrolled in the Burlington Credit Card reward program.

Burlington Credit Card Reward points

Just like you’ve learned above, you can earn one point for every $! Spent on purchases made inside their store. Here’s how that pans out for you:

- 100 points get you $5 in rewards

- 500 points get you $25 in rewards

- 1,000 points get you $50 in rewards

- 2,000 points get you $100 in rewards

Take note that for the above to be valid, the card holders must be enrolled in the Burlington Credit Card Rewards program. You need to read and understand the terms and conditions but make sure that you know and get yourself updated as it could change at any time.

What can you buy with the Burlington credit card?

There are many things that you can purchase with this card. Users often purchase the following with these cards:

- Coats

- Men’s apparel

- Female fashion accessories

- Gift cards

- And more

Use of Burlington credit card elsewhere

Take note that these cards are not linked to Visa or MasterCard, so they can’t be used anywhere else except at Burlington stores or on their website. If you live in Europe or Africa, it is hard to be able to get a credit card except if you have a second address in the US and you shop there when you’re in town. There also appears to be a branch of Burlington in Puerto Rico but I don’t have enough information about that. A good thing about the establishment is that it expanding, which means soon, the company may open in other countries subject to the laws of that country.

What about fees associated with the credit card?

There could be fees attached but for you to know, you have to visit a local store near your area, and you can refer to the Credit Card Agreement. It appears that differs from place to place because of factors like local laws.

The credit card from Burlington prides itself on transparent pricing that makes customers come back again and again. The company places a high value on transparent rate quotes. The information on the company website explains things better in this regard. To support this, ratings online show that the company has almost no complaints from reputable online watchdogs. That’s a big factor for the company, but things may change in the future (we hope not).

Learn more about automatic payments

Automatic Payments: These are used to authorize an ongoing deduction from your account. It is used to pay your Burlington credit on the date the payment is set to go out on the payment date. You need to schedule it in these ways:

- Minimum due

- My Balance

- Other Amount

Before any money is deducted, you will have received a reminder by email 10 days before it is deducted. Take note that the deduction will occur through any option that you set previously.

To set automatic payments, make sure you are logged in and then visit this payment page to do so. On that page, you can also cancel the automatic payments if you like. The cancellation should be requested by 11:59 pm Eastern Time the same payment due date.

However, sometimes when you set automatic payments, either an increased sum is deducted or a decreased sum is deducted. Why this?

- An increased sum is deducted because the Other Amount that you previously set is lesser than your Monthly Minimum Due. The automatic payment will be increased to meet the minimum due

- The automatic payment is decreased to meet the payment when your Other Amount set is greater than your monthly statement new balance

Take note that when your billing statement new balance is zero there will be no automatic payment withdrawn in that month.

Gift Cards

Burlington is not a charitable organization that donates gift cards or gets involved in philanthropic fashion shows, auctions, raffles, etc, but it can also partner with those organizations especially if they need to purchase large items or goods.

You can find both eGift Cards and Plastic Gift Cards, and these are available in various designs. Some organizations that offer bulk gift cards have found the services of Burlington very dependable. You can send a gift card to:

- A friend

- You

There are no extra charges to be paid when you’re purchasing or sending gift cards. Buyers only get a charge on the face value of the card. Once a card has been paid for, that’s it. The value can’t be changed. To buy a gift card from Burlington use the following payment methods:

- Visa

- MasterCard

- American Express

- Discover

Your gift card recipient can receive the card on the date you want him or her to get it. It is instant – sent through email. There are hardly any delays. If it is an eGift Card, you may print it out in either colored or black and white. Both are okay. But you have to be careful so that no one else lays their hands on your card. Once the number on it has been redeemed, that’s it. No matter how many you print, they are no longer valid.

If your gift card is plastic, it must be shipped, and may take some time for it to arrive. Generally, that could be just one or two business days. Choose standard shipping to get it shipped without you needing to pay anything. However, you could add some funds to make the shipping faster.

Common challenges when operating your Burlington account

Locked out your account: Because of multiple failed attempts to log in, the system will lock the account temporarily to protect the user. An email will be sent to your private email for more information on how to unlock your account. Some who lost their username and password may want to quickly pay a bill and can do so when they visit this link. They can pay the bill without login in from that link.

Avoid late payment charges: sometimes a user may see that the payment has to be done on a day. He or she may wonder when the time expires on late payment. To avoid paying late and getting charged, ensure that you pay at least the minimum amount due before 5 pm on that same day. It is important to note this if your payment is due today.

Username or password not working: It is possible that you failed to type any of those properly. Maybe you forgot your password. Either way, you could follow this link to recover a lost username or password.

Is there an app?

No. Burlington does not appear to have an app at this period. To apply for a credit card users have to go to their website or visit their local stores to apply for a credit card.

Manage your Burlington credit card online

For everyday people, keeping track of card spending and statements can be hard enough. Because one can do that online, everything seems simple. Everything can be seen and managed by customers when they are on Burlington’s website. Yes, keep track of statements, costs, and invoices online.

Is Burlington a reliable company?

There are good and bad things to say about most companies worldwide. The same is true of this company. However, complaints are very few. You can hardly find them on the internet. That means the company is reliable. It also maintains a high BBB Rating online. It has an A+ rating from Better Business Bureau. There’s been no complaint since 2018, the year it joined the BBB.

Conclusion

Burlington credit cards are not for everyone. You really don’t need an email to apply for the card online but you will certainly need it if you desire to enjoy the rewards club. These cards are specially designed for Burlington customers at this time. There are great benefits and you don’t even need to invest a lot of money to get these rewards. The company has stood the test of time and it is still doing a lot to benefit its teeming customers. The main reason for this success is that Burlington has various reward options for customers and all of them are easy to reach.