We know it’s important to save money, and some do save, but there comes a time when particular circumstances happen, and we need extra cash to carry us through. Maybe it’s a hospital bill we need to clear, or we need to fly out to enjoy holidays in a resort. We’ll need some sorts of loans and that where loan apps come in. There are apps that offer you loans in a fast and convenient way. Here are the 5 best loan apps in the US.

Best Instant Loan Apps

-

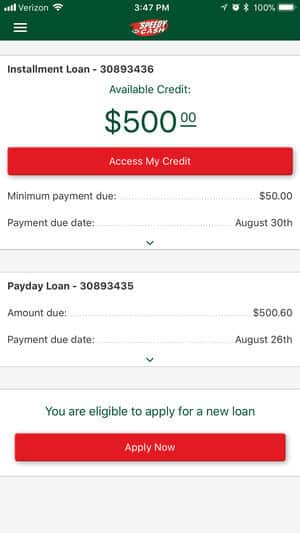

Speedy Cash

With Speedy Cash apps, you can get short-term loans. Do this by registering for this service by tapping Apply Now. The registration is simple and easy to do. The app gets you loans quickly and easily, and you don’t have to visit the banks to request loans. By just launching the app, you get loans as simple as ABC. Security is guaranteed as the app processes payment in a secure way. Just like it is with other loans, you have to pay back, make sure you’re cautious, so you don’t run into massive debts. The app has notifications and reminders so that you can have it in mind to pay. You can manage your account within the app, apply for a loan refinance, and change a due date.

2. Earnin

Earnin works on the approach of giving you access to your payment whenever you are through with work. You supply Earnin the necessary information about your workplace and add your bank account. The Earnin system monitors and tracks the number of hours you use so that you can collect payments when you need to. When your paycheck arrives, the money you’ve taken is removed from your paycheck. Earnin doesn’t need you to pay anything to use their service. There are no charge fees or interest. If you want to support the company, you can send in a tip.

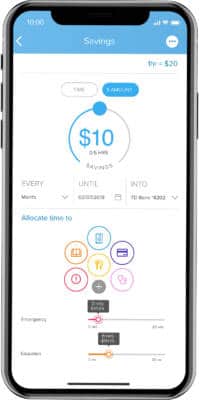

3. PayActiv

What if you need some cash for treatment at the clinic or you want to buy that watch you’ve been looking at in the boutique, and your salary may not come too soon? You need to act fast! Banks may be a good option, but the process of releasing a small amount of money in most banks is slow, so you’d have to rule that out. Another way out you may think of is to borrow money from friends and maybe family, but they too may be in a different financial situation. So what do you do? PayActiv is there to rescue you! With this app, you can collect up to half of what you earn. You can also get paid when you need it. The registration process is easy, and the app is generally easy to use. Other features that the app packs are bill pay, savings, budgeting tool, discounts, financial health counseling.

4. FlexWage

Just like PayActiv, you can use FlexWage to get access to your earned wages on demand. This way, you reduce the financial stress and burden on you. Employees, on the other hand, will find it easy to administer payroll instead of the stress in issuing payroll advances. With payroll, you get reloadable payroll debit cards as an employee. So if you’re unbanked and can’t accept direct deposit, it is a good choice for you. They charge, however – $5 for on-demand wage transfer and charges from using the debit card.

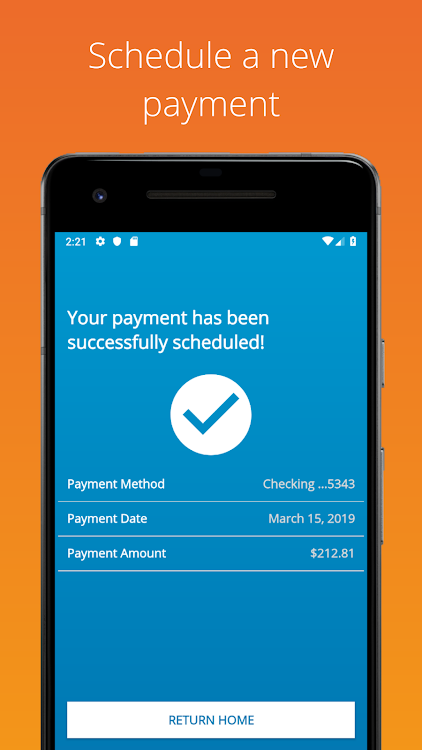

5. CashNetUSA

Customers say CashNetUSA is the best payday loan and looking at its rating at 4.7 ratings. From your Android device, you can get a loan, quick and easy. You’ll get your loan in minutes. The app gives you a convenient way of getting money when you need it, and you don’t have to be used to any payment schedule. You can get details on your loan – the balance and status. The app lets you set up reminders and account status updates. Payments can easily be made, and the app offers swift support.