Since October 8, 2018, many consumers have been shocked by some local banks who have begun automatic registration for the DuitNow service – as well as whether the SMS they received about this new service was authentic or otherwise. It is added with its own DuitNow site as it is not ready yet and does not use HTTPS, while making some web browsers display it as “Not Safe“.

However, for all users, DuitNow is the latest banking service introduced by PayNet – one of the agencies under the National Bank. PayNet has also led several banking services, including the MEPS for cash withdrawals through ATM, as well as JomPay which facilitates bill payments.

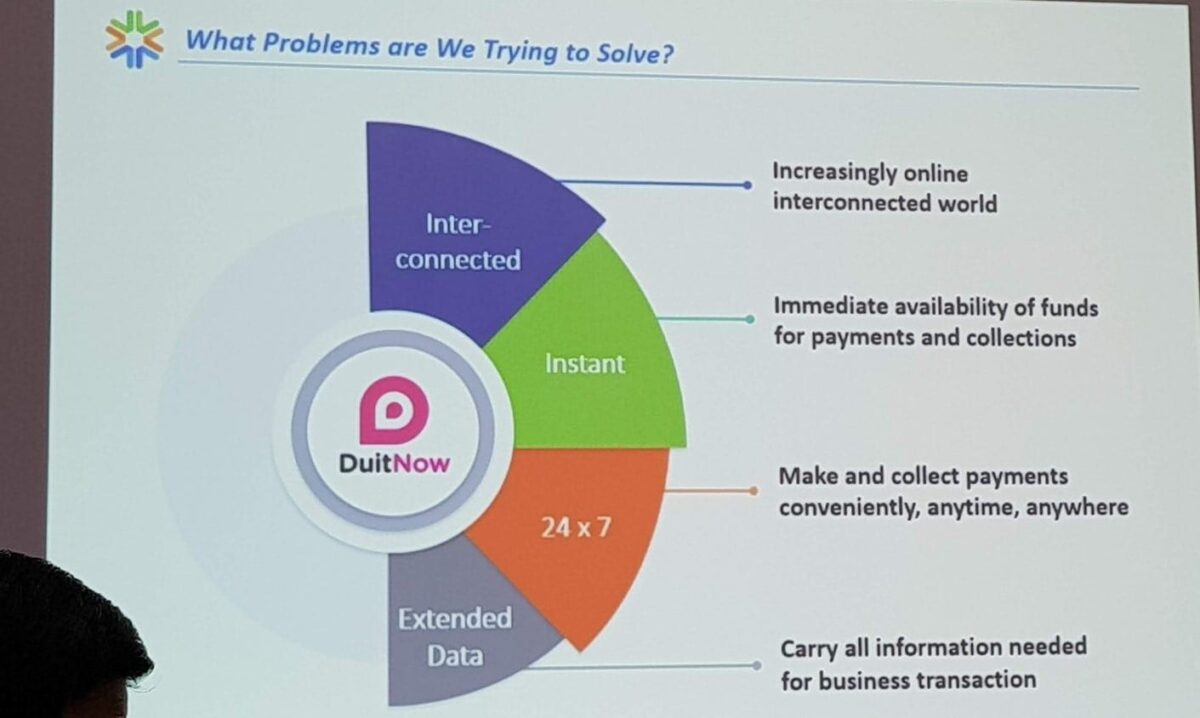

Why DuitNow?

DuitNow is a new banking service that wants to make it easy for users to send money to someone – and is not bound to the use of bank account solely.

Through DuitNow, someone can link phone numbers, IC number (MyKad), or passport numbers (for non-citizens) to their bank account. After linking them, users can receive payment to their account directly using any number. This step will also facilitate multiple payment processes.

For example, through a demo demonstrated by CIMB to us for the use of DuitNow, users can enter the recipient’s account number by simply selecting them from the address book address book – and making payments. This also facilitates payment on mobile devices.

Additionally, DuitNow’s use will also make it easier for government companies or agencies to pay directly to your MyKad. For example, employers can pay directly to MyKad numbers, and no longer need to ask for bank account numbers and so forth from their employees. The same thing is for the government to make a payment directly to the people, and to facilitate the record keeping.

At the same time, DuitNow also supports the company’s banking accounts. This means that companies can link their company registration accounts to bank accounts – and then receive payments made to their company registration accounts. This may also increase the confidence rate of a buyer on a company concerned.

Overall, this DuitNow is seen as a PayNet step to facilitate users to remember payee information.

How DuitNow works?

DuitNow works just like a regular banking, where users will need to enter a phone number or MyKad number at the recipient’s place, and then enter the amount. As with the normal payment, the user will be taken to the next screen to verify the recipient information (such as name). Once confirmed, the transfer of money will be done as usual.

DuitNow offers free transfers for under RM5,000.

According to PayNet, if a phone number or MyKad is not linked to an account number – then it will display a message where the recipient does not exist, as well as not allow you to make money transfer.

Use Phone Number / MyKad

Many users who are worried about SMS acceptance since the beginning of October, because the bank did not disclose it well to the consumer before implementing it.

Each phone number or MyKad can only be linked to one bank only. For example, if you have received an SMS regarding the phone number linked to the Maybank account, then you can not use the same phone number for another bank account. You need to un-register it before you can use it on other banking services. The same is true for MyKad.

Currently, the bank still does not provide a management panel to link this phone number or MyKad to a bank account. This will change on December 8, 2018, when various local banks are introducing this functionality directly to their online banking services for management.

In fact, via a brief demonstration publicly displayed by us, they also include “Switch DuitNow” support that allows you to transfer the DuitNow registered phone number from one bank to Public Bank. Likely, many other banks will also include the same features.

However, at the moment, registration and unlisted views are managed via bank online or using mobile apps only. It still cannot be managed through ATM services for now.

Security?

With the use of phone numbers, many people who are worried about it will be mistaken and commit a transfer accidentally. This is one of the things you do not need to worry about. This is because money transfer to DuitNow is only one way – and can be done using online banking or mobile applications. Users can only receive payments using their phone number or identity card number. Users can not make payments using their phone number but instead must do so via their bank account as usual.

What’s Next?

The introduction of DuitNow is expected to be a turning point for a number of other things in the financial arena. For example, with this introduction of DuitNow we may also be able to see PayNet using the same framework in the introduction of a universally awaited universal QR code system. In fact, it may also facilitate other financial technology (fintech) companies in integrating payment facilities, and improving their bidding. As always, we are looking forward to this 8 December 2018 to see the introduction of this DuitNow service as a whole, and whether it will be popular among local users – or users will still be more comfortable using bank account numbers like today.