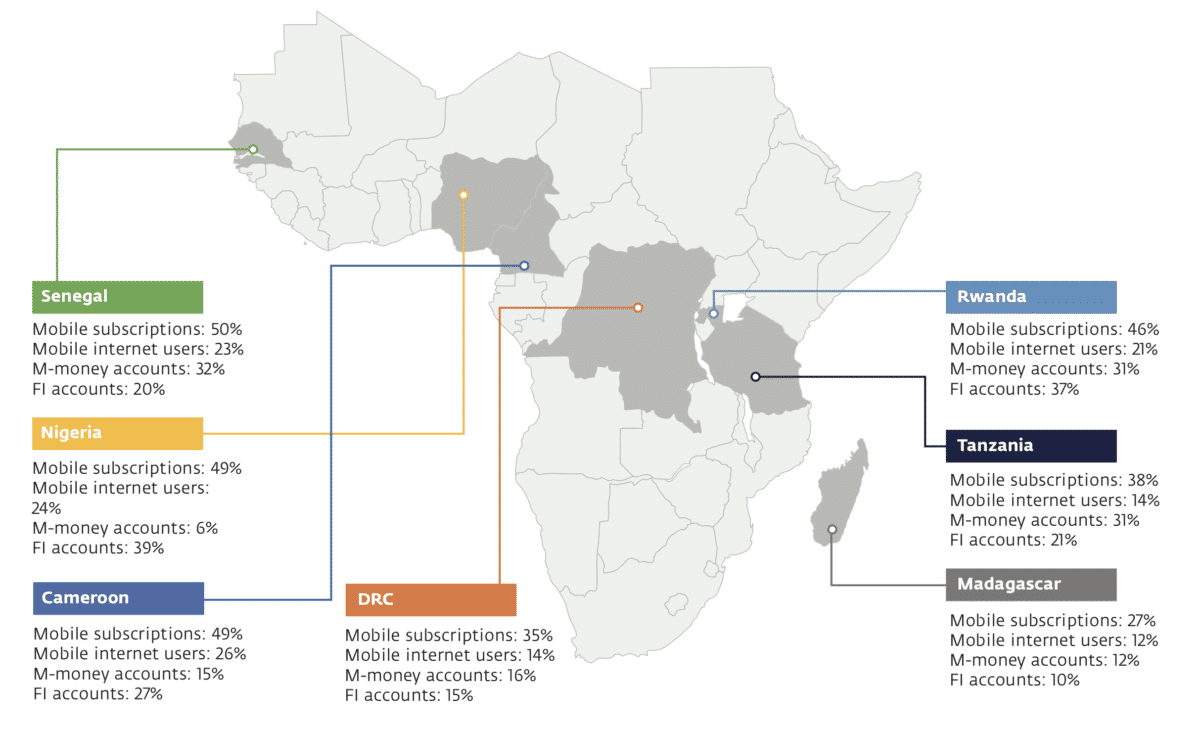

The ongoing Fourth Industrial Revolution is a technological transformation that is changing the way we live, work and communicate. It is altering every aspect of our society and economy, including the financial sector. In Sub-Saharan Africa, 44 percent of the population subscribed to mobile services in 2024. By 2025, the number of subscribers is expected to grow to 52 percent, and 87 percent of those subscribers are expected to have mobile broadband access. Results of a recent Global Findex survey reveals significant progress in financial inclusion driven by a new generation of financial services accessed through mobile phones and the internet. Still, with 57 percent of its population lacking any form of bank account, Sub-Saharan Africa remains the region with the most significant potential for the adoption of Digital Financial Services.

Banks, telcos, ministries of finance, central banks and leaders in the banking industry from 10 nations across the West African region are set to gather in Lagos at The Future Banking Technology Summit to discuss efforts aimed at increasing financial inclusion in the sub-region by 2020.

The Future Banking Technology Summit will address over two days of panel discussions and case studies showcasing the full value chain of the region’s banking and financial sector to best achieve financial inclusion and sustainable banking sector growth.

Commenting on the Future Banking Tech West Africa Summit, Khalila Baldwin, the Director of the Summit said- “At such an exciting time for the financial space in West Africa, we knew it was imperative to launch an event capturing as many of the dynamic components of this sector as possible. A key focus of our event and many new policies being driven within the region is to ensure financial inclusion is increased across West Africa. We, therefore, wanted to shine a light on the leading strategies increasing access to finance with the top financial stakeholders in attendance”.

“Late last year the Central Bank of Nigeria announced the introduction of Payment Service Banks, and amidst so much buzz around Telco’s entering the financial space in Nigeria, we also wanted to provide a platform for both the traditional and non-traditional financial entities to converge” Baldwin added.

Digital strategies are dynamic, requiring constant readjustment based on client feedback and changes in market conditions. Although all Financial Institutions had a compelling business plan and strategy before developing their Digital Financial Services, these had to be constantly fine-tuned and adopted to grow their businesses successfully. The original DIGITAL FINANCIAL SERVICES assumptions, in particular around client outreach and uptake, had to be adjusted to the realities of financial services providers. Moreover, a digital strategy requires internal support from staff, and a financial institution has to define ways to overcome their clients’ initial resistance and fear of going digital. The study also revealed that most successful DIGITAL FINANCIAL SERVICES implementations used robust data-driven approaches to monitor and assess DIGITAL FINANCIAL SERVICES operations and they are using those insights to refine products and services, thereby improving customer service and the overall experience. That said, given that most FIs in the study started their DIGITAL FINANCIAL SERVICES offering from scratch, internal capacities needed to be built and the costs for that development were often higher than anticipated. The institutions also had to learn how to assess and work with external partners (i.e., mobile network operators, technology companies, among others). For several of the participating FIs, managing partnerships was a challenge. Concerning agent banking, FIs saw the importance of prioritizing quality over quantity and providing the right incentives to network agents.

The first of its kind event will focus on the future of digitizing banking services for Central Banks in West Africa. This is as leveraging off experiences of similar regions can aid in the adoption of best financial inclusion practices, as it is becoming incumbent on banking stakeholders to be rapid, yet savvy in incorporating disruptive mobile money platforms, automated banking systems, tailored credit facilities and crypto-currencies for this dynamic market.

The two days summit will also tackle several paramount topics including, innovation in regulation- Overcoming gaps in rural banking strategies, supporting innovative financial institutions to improve financial inclusion, improving credit facilities to underbanked and Small and Medium Enterprises, throughout main panel discussions and networking breaks.

Future Banking Tech West Africa Summit will include case studies from nations that had similar stories, that have increased access to finance through changes in regulations such as mobile money licenses for non- banks and pushing agency banking. To showcase this, the 2-day summit will begin with discussions from some of the region’s regulators, including Dr. Mudashiru Olaitan, Director, Development Finance Department, Central Bank Nigeria as he describes the innovative platforms being adopted, adapted, and implemented to increase financial inclusion. The second session is a panel discussion with EFInA, Central Bank Nigeria and the Ministry of Finance, Ghana as they further examine the best strategies to enhance rural access to finance.

Then the program shifts to the traditional bank, that must identify the best solutions and FinTechs to support their commitment to financial inclusion and ensure the greater customer experience. The morning sessions will also feature two of the world’s leading banking software providers, Infosys Finacle and Temenos as they highlight how their solutions help banks accelerate their digital transformations and increase inclusive banking, respectively. As mentioned, the morning will also feature two case studies, one from Ghana led by Kwame Oppong with World Banks’ CGAP and the other from Ethiopia led jointly by Ethiopia’s My Amole project owners (Dashen Bank and Moneta Technologies).

Both case studies will shine a light on the programs introduced nationally to improve financial inclusion while leveraging on technology directly. The next session will feature the Managing Director and Chief Executive Officer from one of the region’s leading banks, the conference’s Official Banking Partner, FirstBank Nigeria. Dr. Adesola Adeduntan is expertly suited to address the future of CX/ UX in West Africa’s banking sector, as this year marks FirstBanks 125th anniversary of delivering benchmark customer service.

Day 1’s afternoon sessions begin with an executive CIO panel discussion covering the Digital Financial Services Landscape in West Africa featuring Access Bank, Union Bank, UBA and Ghana Commercial Bank. A key part of improving access to finance through digital channels is ensuring additional security.

The next session will feature Forcepoint, the leading cybersecurity solution provider, discuss the role of human-centric cyber security for IP protection. Continuing on with the topic, Bharat Soni, Chief Information Security Officer, Guaranty Trust Bank will expand the discussion with Enhanced information Security within West Africa’s banking sector. Post lunch will feature EFInAs (Nigeria’s Enhancing Financial Innovation & Access) Ashley Immanuel, Head of Research announce insights from their biennial “Access to Financial Services in Nigeria 2018 Survey” to truly understand just how much progress has been achieved, and what recommendations are set.

Onyebuchi Akosa, Group, Chief Information Officer, United Bank for Africa will then discuss open banking strategies and data sharing networks. Finally, the day will wrap up with two leading Fintechs, Intellect Design Arena and Citius Kenya as they showcase their innovative solutions for the banking sector.

The summit brings together under one roof dignitaries from various industries across West Africa countries to exchange visions on ways of achieving progress in financial inclusion, that is becoming highly sought for recently to cater the demand of the population, and the rapid penetration of latest telecommunication technologies by customers.

Wednesday 24 April, Day 2 of the conference, will open with the West Africa microfinance panel discussion, which will cover improving credit facilities for underbanked and SME’s. Our panelists include PWC, Mainstreet Microfinance Bank, New Capital Multipurpose Cooperative, AB Microfinance Bank Nigeria and Supreme Microfinance Bank Nigeria.

The next session with Christian Ayiku, CFO, Consumer Bank Group, EcoBank Togo will discuss modern core processing systems with a focus on FinTechs. Leading mobile payments solution provider BlueCode will then deliver a session regarding domestic payment schemes, interoperability and electronic payment solutions for the banked and under-banked. An element that has been introduced in the race to increase financial inclusion is the significance of enhancing financial literacy to ease adoption to finance.

Kofo Salam-Alada, Director, Consumer Protection Department, Central Bank Nigeria will address this element as it is under the purview of his department. He will also address the regulations building consumer protection in the digital age. Day 2-morning sessions will end with another session led by EFInA, Dayo Ademola, Head of Innovation, will discuss the Fintech Landscape in Nigeria Survey.

The next session will be an executive panel discussion, Developing West Africa’s cashless economy, which will dissect the barriers to achieve financial inclusion. This session will include Rack Centre, First City Monument Bank, Ecobank Nigeria, My Amole and Eclectics International. MTN Nigeria will then deliver a session on how telcos can collaborate with industry players in the financial services space to enhance financial inclusion.

Our final presentation will cover identifying customer-centric models for digital banking, and this will be delivered by Stanbic IBTC Banks’ Wilfred Mamah, Head Digital Strategy, Issuing and Service Management.

Finally, it was important to include two masterclasses surrounding the elements that required a bit more in-depth discussion and study. Post lunch on Day 2 will be the first masterclass, Information Security, led by Tope S. Aladenusi, Chief Strategy Officer & Cyber Risk Services Leader, Deloitte West Africa. His class will be an interactive dive into multi-channel security across the increasingly digital financial sector. Key aspects to be addressed include denial-of-service attacks, data breaches and limiting cyber exposure risks.

The second masterclass will cover blockchain and touch on the additional cryptocurrencies that are emerging within the region. This will be expertly led by Lucky Uwakwe, Chief Operating Officer at Blockchain Solutions Limited.

The Future Banking Tech West Africa Summit’s distinguished event chairman, Dr. Evans Woherem, Founder and Chairman, Digital Africa Global Consult Ltd and Compumetrics Solutions will then summarize and finalize the program.

A decade after mobile phones began to spread in Africa; they have become commonplace even in the continent’s poorest countries. In 2016 two-fifths of people in sub-Saharan Africa had mobile phones. Their rapid spread has beaten all sorts of odds. In most African countries, less than half the population has access to electricity. In a third of those countries, less than a quarter does. Yet in much of the continent people with mobile phones outnumber those with electricity, never mind that many have to walk for miles to get a signal or recharge their phones’ batteries.

Mobile phones have transformed the lives of hundreds of millions for whom they were the first, and often the only, way to connect with the outside world. They have made it possible for poor countries to leapfrog much more than landline telephony. Mobile-money services, which enable people to send cash straight from their phones, have in effect created personal bank accounts that people can carry in their pockets. By one estimate, the M-Pesa mobile-money system alone lifted about 2% of Kenyan households out of poverty between 2008 and 2014. Technology cannot solve all of Africa’s problems, but it can help with many.