Best Quick Loan Apps in Nigeria are not easily available for the majority of citizens. Or if available, people that live in that region are not fully aware. A quick loan is something we look for very often in our day-to-day life. Especially people who run small to medium businesses in Nigeria. Some people need loans to expand their business whether its an online business or offline and some people need it for their personal purpose. Meanwhile, in life, the emergence of quick cash comes very often. The universal way of getting a quick loan in Nigeria is getting in touch with banks that are out there.

Page Contents:

But that takes too much time to get things final and so, we barely use banks for quick loans. Rather, we contact our neighbors or friends to borrow some cash to fix things or overcome a bad financial situation in a short time. And that only takes a few minutes and some extra cash when returning them back. Well, this is also not a final and beneficial way to get quick cash or a quick loan. Because your friends or neighbors may deny or ask for a high amount in return.

Today, getting a loan from an organization is the only secure and best way. However, they charge normally, you will be secure, and most importantly they may not press you hard for return their money even if the time period will get over. They may charge a little extra for overtime periods but they will not act hard as others do.

So, today, we will show some of the best quick loan apps which will provide you quick loans in Nigeria in real. Let’s get started.

Quick Loan Apps In Nigeria

Most of the Quick loan Apps available in Nigeria are run by organizations. These apps provide a great service to the citizens to get quick loans without getting cheated by fraud. The apps ensure that the citizen’s personal details stay safe and they get quick loans from the comfort of their home or office. These apps follow the same process that banks and other parties do like Paperwork, Agreement, etc. The benefit that it provides is that it eases the process and people don’t have to go to places to submit documents and all stuff.

Loan apps build by developers and get tested by hundreds of times to ensure everything works perfectly. And so, the chances of getting anything wrong in the process of getting a quick loan through the apps are rare. Even you can complain and contact the particular loan service in few seconds if anything goes wrong. Moreover, people who will take loans using apps will get the best perk because these apps mostly list the best deals only. Some apps provide direct service to get loans and some refer to the loan organization by partnering with them.

Both the type of loan apps are safe & secure. From both apps, you can grab the best loan deals. So, now, let me share with you some of the best trusted and secure Quick loan apps for Nigeria. The apps that we are going to list here works and they are authentic.

Best Quick Loan Apps in Nigeria

Here are the best Quick Loan Apps in Nigeria for personal purposes and Business Owners:

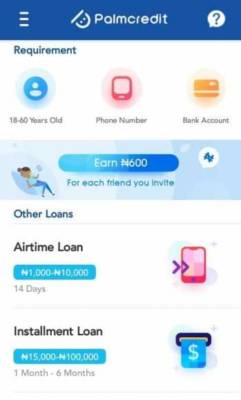

1. Palmcredit

The No.1 fastest quick loan app which is available for Nigerians. Palmcredit has become a very trusted and popular loan app in Nigeria. Probably because of its service quality. It provides one of the best interest rates compared to any other loan apps. Also, it has made the loan process very fast. Palmcredit will provide credits within minutes and the only thing you have to do is to make your profile and apply for a loan. With Palmcredit, you can take a loan up to ₦100,000. You can also take any amount under the highest limit like ₦1,000-10,000.

The higher loan you will take, the higher and more interest you have to pay. The maximum time to replay the loan is 28 days. And if you fail to completely repay them till the time period over, you will be charged extra as a fine. Also, it has a score feature for every user meaning if you repay them before the time period, they will see your performance and increase the loan limit. Therefore, you will be able to take a loan of more than ₦100,000.

How to Get Started with Palmcredit?

- First, click here to install the app on your phone.

- Fill up your personal details like Name, Address, what you do, etc.

- Browser loan options and select one which suits your need.

- Fill the form and process the loan.

Must check out this if you really want a loan fast and easily.

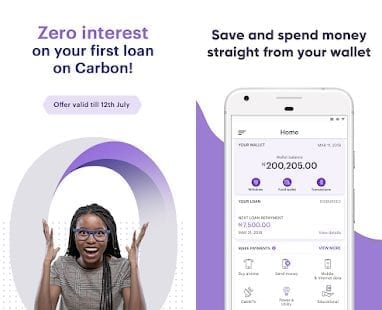

2. Carbon (Paylater)

Carbon well known as Paylater is an online financial service which let you control finance in few clicks. Whether you want a short-time loan or invest your money to double the money, It’s all available in this application. Also, you can use this application to pay bills as well like Mobile bill, Electric bill, etc. Coming to the main part, you can get a loan maximum up to ₦1,000,000 but it has some Rules. If you have that kind of wealth in any form like Land, Jewellery, Diamond, etc then you only get a loan. But its really useful who can afford a loan. However, Carbon will give you your first loan without charging any interest. That’s amazing!

Nigerians should not miss this opportunity, take a loan from Carbon (If you can afford) and invest it in your business or startup. When we invest money in business, chances it doesn’t go waste even increases the chances of getting higher revenue. So, once you get the revenue from your business in the time period of 2 months, you can repay the loan. This way you will be able to get a loan and grow your business without any loss.

How to Get Started with Carbon (Paylater)?

- Install Carbon (Paylater) app on your Android phone.

- Complete your profile.

- Select a suitable loan from the section.

- Apply for it.

- Wait to get approved.

- Receive the money in Bank account.

It is that simple to get started with Carbon (Paylater). I highly recommend checking this application if you are looking for a short-term loan.

3. FairMoney

FairMoney is one of the best quick loan apps in Nigeria which provides affordable loans for Medium to high levels. You can take loans up to ₦150,000 without doing much paperwork. We all hate paper works because it’s boring and consumes a huge time. We want to do everything fast and FairMoney understands. And that’s why they have made the loan process quick fast and secure. FairMoney charges an interest rate of 15 – 30% meanwhile, the more cash you will take the more you will have to repay them. The best part is it gives due time to max 6 months which is really interesting. Also, you can spread repayments in multiple installments for more flexibility and ease.

How to Get Started with FairMoney?

- Download the FairMoney and Install it on your phone.

- Make your profile with all the real details such as name, address, DOB, etc.

- Browse loans under your limit.

- Click on the apply button and wait to get approval.

- Done.

FairMoney will be a great option if you like to repay in after months like in 6 months after taking the loan.

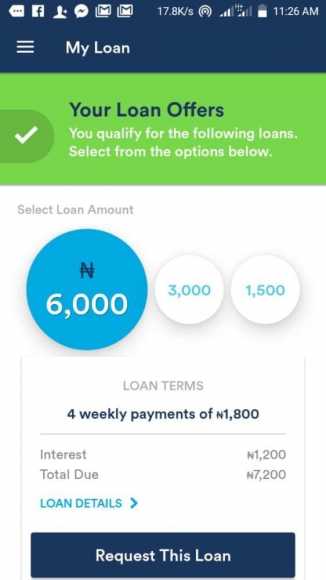

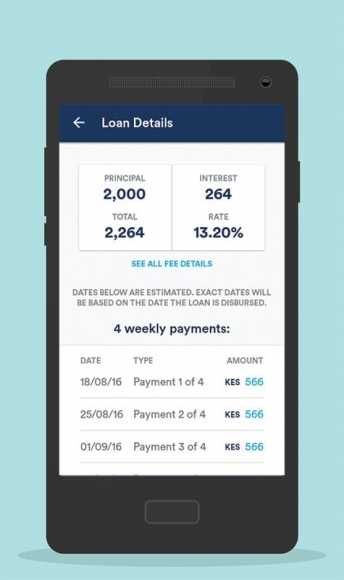

4. Branch – Personal Finance Loans

A great quick loan app for Nigerians especially for those who scared of a Loan scam. The Branch is one of the best personal finance and loans service which is trusted by millions of Nigerians. It has a rating of 4.6 and all the feedbacks are positive & authentic. It provides loan straight and in less time. ₦150,000 is the highest amount you can take as a loan from Branch. Its service is uncomparable and many Nigerians have used it for a quick loan (according to comments). It provides the loan service 24/7 and you can request for a loan anytime, anywhere.

How to Get Started with Branch – Personal Finance Loans?

- Install Branch on your phone.

- Create your account.

- Apply in seconds.

- Receive your loan straight into your mobile money or bank account.

- Build your loan limit every time you repay a loan.

Try this without thinking the second time because you are about to get loans from the right place.

5. QuickCheck Loan App

When it comes to the Best quick loan apps in Nigeria, QuickCheck is what must be present in the list. Because of its incomparable service and honesty. QuickCheck Loan app is run by African Entrepreneurs and it is doing well for more than 2 years. More than 100,000+ people have trusted it and used to get a small loan in a very short time. They charge an interest rate of 1% per day. Suppose you have taken a loan of ₦50,000, then you will be charged 1% of it every other day. It also uses a scoring system to track users’ repayment and if found all good, they increase the limit for the particular user.

How to Get Started with QuickCheck Loan App?

- Sign up in the QuickCheck Loan app.

- Make profile.

- According to your need, browse loans.

- Apply for it.

- Receive cash in your bank in a few minutes.

In the recent update, they have increased the maximum loan limit to 200,000 nairas. So, now you can also request a higher amount if your credit score is good.

Read it– Loom Nigeria Ponzi- Loom Money Nigeria Official Website

Conclusion

So, that is it… you have reached the end of this article. Above, we have suggested the best quick loan apps in Nigeria. We have confirmed that all are working and open for loans. So, pick one and get a loan for your business or personal purpose. If you have any suggestions or questions, you can drop them below. We will get in touch with you ASAP.