Money lending apps are popular in Kenya and are giving banks a run for their money. The reason is that people prefer the convenience of accessing loans wherever they are without going through the stress of loan processes in banks

Are you in a fix or dire need of money, and you don’t want to approach banks? Why not try the money lending apps listed here and get funds whether you’re at work, home, or school. Check out the best loan apps in Kenya.

Mobile Loan Apps in Kenya

-

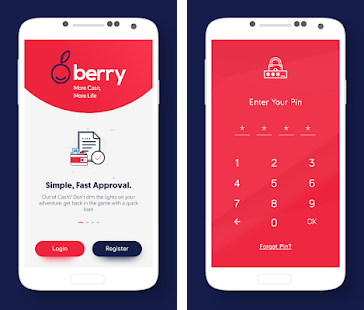

Berry

Berry offers mobile money lending in a unique way. You can download the app and have access to low-cost loans in Kenya. The repayment schedules are flexible, making it a convenient means of obtaining loans. Just head on to the Google Play Store, install it, and register to apply for a loan. After your identity has been verified, you can request for loans. You can only receive up to Ksh. 500 on the first loan request, after which that limit goes up to Ksh. 50000. Berry charges 9-16% of the principal amount on the loans.

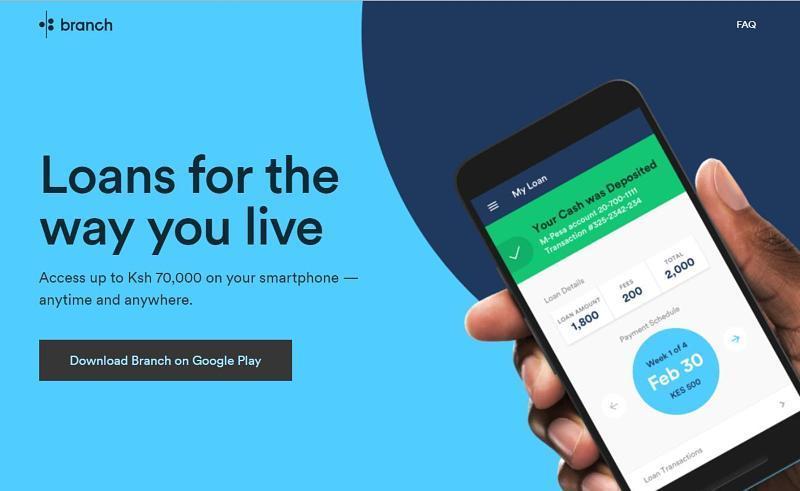

2. Branch Loan App

Branch, which is a San Fransisco company, also operates in Kenya via a subsidiary in Nairobi. You have to be s registered Mpesa user to qualify for loans. Furthermore, for you to qualify, you must have an active official Facebook profile, and your usernames must match your National ID card. When you are done with installing Branch loan app on your device, connect the app to your Facebook account, and provide the necessary details. An SMS will be sent to you for verification purposes, and you’ll verify by opening the link sent in the SMS. The minimum loan limit of Branch is currently Ksh 1000.

3. Tala

Formerly called Mkopo Rahisi, Tala delivers loans within the shortest time – in about 5 minutes. Tala groups loans into three stages, namely bronze, silver, and gold. If you’re just a new user, you are placed in the bronze category, and you have access to Ksh 500. For those in the bronze category, they can get loans between Ksh. 500 to Ksh. 4999. As you use the app and pay up your loans on time, the limits gradually go up.

Download

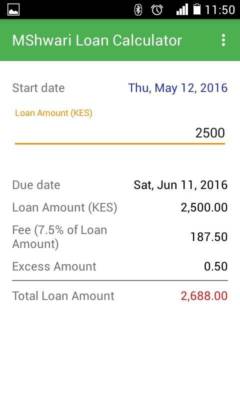

4. MShwari

Only Safaricom customers are eligible for Mshwari loans. The loan platform was founded by M-PESA in partnership with the Commercial Bank of Africa (CBA). The minimum loan that the platform can let you have access to is 100 shillings, and for the maximum amount, it is determined by how one saves. You can raise your loan limit higher by replaying the first loan on time. The interest rate on the loans is 7.5%, and you are given a time of 30 days to repay the loan. Once approved, you’ll receive the funds in your M-Pesa account within 5 minutes.

Download

5. KCB Mpesa Loan

KCB, in partnership with Mpesa, created KCB Mpesa, which began operations in 2015. When you register and activate your account, you will see your loan limit, and you can borrow from there. Funds gotten from the loan platform are sent to the KCB M-PESA account. You can get loans between the ranges of Kes. 50 to Kes. 1M. You are required to pay up within 30 days. After interest, negotiation fees, and excise duty have been deducted, and you’ll have access to your cash in your KCB M-PESA account.