The Bank Verification Number (BVN), also known as the BVN, is a crucial identification number in the banking sector. It was introduced on July 14th, 2014, through a collaboration between the Central Bank of Nigeria (CBN) and the Bankers’ Committee. It is now a mandatory requirement for all bank account holders in Nigeria to possess a BVN in order to conduct transactions. Generally, all Nigerian bank account holders who are 18 years and above have a BVN, which can often be found in their bank app for those who use Internet banking. It is essential for Nigerian bank account holders to know their BVN and one of the easiest ways to check their BVN is online. In this article, we will provide a step-by-step guide on how to check your BVN online. However, before we delve into that, let’s discuss what the BVN is all about.

Page Contents:

What is the BVN?

The Bank Verification Number (BVN) is a unique identification number that every Nigerian bank account holder must possess. It is a biometric identification system that ensures the authentication of every customer’s identity before any transactions can be carried out on their accounts. This biometric capturing of customers provides them with a unique identity that can be verified across the Nigerian banking industry. Most financial institutions require your BVN when conducting financial transactions with them. The primary aim of the BVN is to enhance security, combat fraud, and ensure the safety of customers’ financial transactions.

How to obtain a BVN:

Obtaining a BVN number is a simple and straightforward process. All you need to do is register for it. Here is a step-by-step process for registration:

- Visit any branch of your bank and request the BVN enrollment form.

- Most banks can register you for your BVN, so provide a means of identification, such as a voter’s card, National ID, driver’s license, or international passport.

- Approach a customer care representative and ask for the BVN enrollment form.

- Fill out the form and submit it.

- Have your biometrics captured by the representative. This involves providing your fingerprints and having your photograph taken.

- Upon completion, you will be issued a ticket ID. You will then have to wait for 24 hours, and your BVN will be sent to you.

- Once you receive your BVN, you can proceed to link it with your other bank accounts. Visit any of the banks you have accounts with and request to link your BVN. You will be given a form to fill in the necessary information for linking. After completion, your BVN will be successfully linked.

How to check your BVN online:

There are several methods you can use to check your BVN online, and we will elaborate on them here:

1. BVN Verification Portal

The first option on our list is through the Bank Verification Portal. To check your BVN using this method, follow these steps:

- – Log into the NIBSS BVN Portal using this link.

- – Enter your details as requested in the provided spaces.

- – Input your password and select ‘Login’.

- – Choose your bank from the displayed list.

- – Enter your account number in the provided space.

- – Provide your first name, last name, and date of birth, which should match the information registered with your bank account.

- – Solve the CAPTCHA code and click on submit. Your 11-digit BVN number will be displayed.

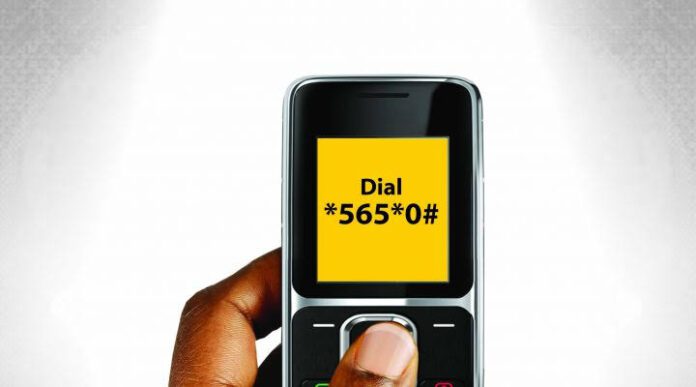

2. Short Code

You can also use a short code to check your BVN. Simply dial *565*0# using the phone number linked to your BVN. After being charged N20, you will receive an SMS with your BVN number. Please note that this short code is applicable to all network providers, including MTN, Airtel, Etisalat, 9mobile, and Glo.

3. Internet Banking Platform

Customers who utilize internet banking can easily check their BVN online through their bank’s internet platform. Follow these steps:

- – Visit your bank’s website or download their mobile banking app.

- – Log in to your account using your username and password.

- – Look for the option to check your BVN. It may be under the ‘Profile’ or ‘Settings’ menu.

- – Enter the required details, such as your account number and date of birth, to verify your identity.

- – Your BVN will then be displayed on the screen.

How to check your BVN on different platforms:

– MTN

Dial *565*0# on the MTN line linked to your BVN. You will be charged N20, and an SMS containing your BVN will be sent to your phone. This code also applies to Airtel, Etisalat, 9mobile, and Glo.

– GTBank App

If you have the GTBank mobile app, you can easily check your BVN. Follow these steps:

- – Log in to the GTBank mobile app using your username and password.

- – Click on the menu icon on the top left of the first page.

- – Under your name and last login, you will see your BVN number fully displayed.

GTBank account holders can also use the shortcode *737*6*1# to access their BVN.

– UBA App

UBA account holders can check their BVN using the UBA bank app. Simply follow these steps:

- – Log in to the UBA mobile app using your username and password.

- – Navigate to the profile icon at the top right corner of the app’s interface.

- – Scroll down to the security information section, where you will find your BVN details.

Alternatively, you can check your BVN on UBA bank by dialing the code *919*18# using the phone number linked to your UBA account.

The BVN is a critical number that controls your financial transactions, and therefore, it should be kept confidential. Account holders can easily check their BVN online using any of the aforementioned methods. In situations where you do not have access to your phone, you can refer to this guide for instructions on how to check your BVN without your phone number.