A new money-making scam, Loom Money Nigeria, is taking over social media by targeting young people to participate in a pyramid scheme.

Page Contents:

The scheme, which is even worse than the collapsed MMM, is luring young Nigerians to invest as low as N1000 and N13,000 and get as much as 8 times the value of the investment in 48 hours.

According to the US Securities and Exchange Commission, a Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors.

“In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors to create the false appearance that investors are profiting from a legitimate business,” the SEC explains.

The Loom Pyramid Scheme is not new to the world. Last month, Daily Mail UK reported that the scheme has resurfaced online all over the world, with different names such as ‘loom circle’, ‘fractal mandala’ and ‘blessing loom’. In Nigeria, its central name is Loom Money Nigeria with individuals creating their own WhatsApp groups such as Preye Loom, Catherine Loom among others.

How does the scam work?

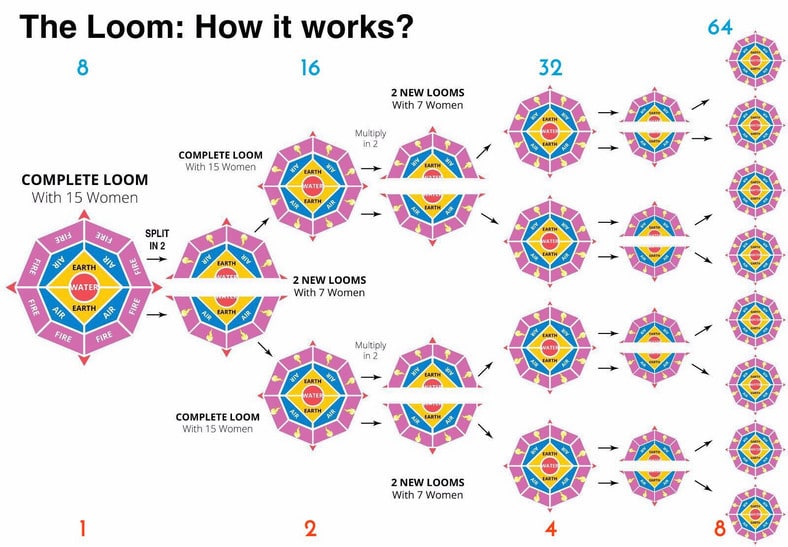

According to one of the WhatsApp groups, the Loom scheme pyramid level is in four places and represented by colors – Purple, Blue, Orange, and Red.

“Each time 8 people join the group, the person in the center (usually on the red spot) gets the target amount which is N16,000 and after investing N2,000 leaves the spot for the next person.

“The Loom would then be split into 2 groups, the top half and the bottom half each becomes new groups and everyone moves into the next level.

“Which means those people that were in purple move to blue, those in the blue move to orange, and those in the orange move to red (the final stage and the cashing out stage).”

In a Facebook post seen by Business Insider SSA by Pulse, the promoter explained that “the more people you manage to add to the circle, the quicker the movement of it, and thus, the easier it will be for you to make your money.”

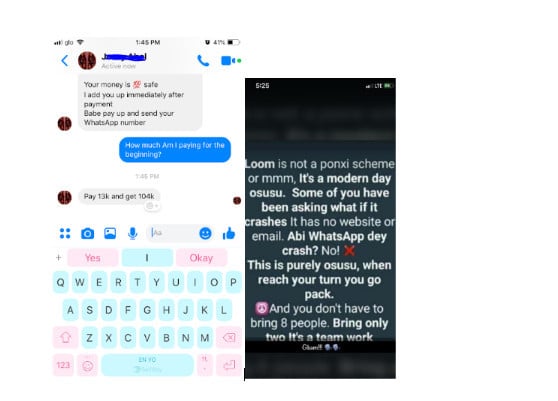

“Loom Money Nigeria promises a staggering easy cash reward of N104,000 for paying N13,000 or N2,000 for N16,000,” the Facebook post reads with a link to a closed WhatsApp group.

Investigations across WhatsApp platforms show that one of the promoters of the scheme on Facebook opened his social media account late 2018 and turned a Facebook page opened for 2019 Nigerian Election into a Ponzi scheme.

Why Loom is more dangerous than MMM

Unlike MMM where there is a website, system information and key person – late Sergey Mavrodi as the major promoter, Loom has no major promoter and operate on the social media via closed groups on Facebook and WhatsApp. Its system is also porous as anybody can create a group either on Facebook or WhatsApp, lure people to pay and shut them out afterward.

In most instances, the Loom promoter is the only Admin and make a judgment on the outcome of the pyramid structure.

Also, there is clear cut defined terms and conditions – the only known condition is for people to bring in cash and well as eight other contributors before a cash-out.

How is it illegal?

Any organization and financial scheme without necessary regulatory approval is illegal and can be sanctioned by the government. In Nigeria, according to the SEC in Nigeria, Ponzi Scheme includes unregistered investments, unlicensed sellers, secretive and complex strategies.

LOOM Money Nigeria is totally different from traditional Esusu

Esusu is traditional forms of cooperative in African societies whereby groups of individuals contribute to informal savings and credit associations for their mutual benefit. It is not run in a pyramid scheme and always have a set of people running it at a particular time.

On most cases, groups of people numbering between 5 and 10 gather and agree to make periodic contributions of a specific amount to each member of the group on a rotational basis.

For instance, if there are 5 people involved and they have agreed to contribute N10,000 per month, they will take a number between 1 and 5 and the first contribution will go to number 1 till it gets to number 5.

It also offers interest-free lending loan to participants.